The Internal Revenue Service (IRS) announced that the Free File program will be extended through 2029, continuing a partnership with the coalition of private tax software companies that allows most Americans to file their federal taxes at no cost.

The advent of IRS Free File represented a paradigm shift for millions of Americans who used this program, saving them millions of dollars in tax filing fee costs. During the current tax season in the United States, the Free File program processed 2.9 million tax returns until May 11, an increase of 7.3% compared to the same period last year, according to data revealed by the IRS.

“Free File has been an important partner of the IRS for more than two decades and has helped tens of millions of taxpayers,” Ken Corbin, head of IRS taxpayer services, said in a statement Wednesday. “This extension will continue that relationship into the future.”

“This multi-year agreement will also provide certainty to private sector partners to help with their future Free File planning,” Corbin added.

Free File Open Until October 15, 2024: Who Is Still Able to Use It?

While it is true that the IRS Free File program is open until October 15, 2024 for the filing of federal taxes by those who requested an extension, the general deadline for filing taxes without an extension has already passed. The general date for filing federal tax returns for the year 2023 was April 18, 2024.

However, those who submitted an extension request received a deadline until October 15, 2024. This date is also the same for members of the armed forces in combat zones, people affected by natural disasters and all those people who can prove a valid cause to get the extension. Keep in mind that filing an extension request and having it granted by the IRS does not give you an extension to make the payment of the taxes you owe.

It is also advisable to file the tax return as soon as possible, as soon as you have it ready, even if you requested an extension.

The Future of IRS Direct File

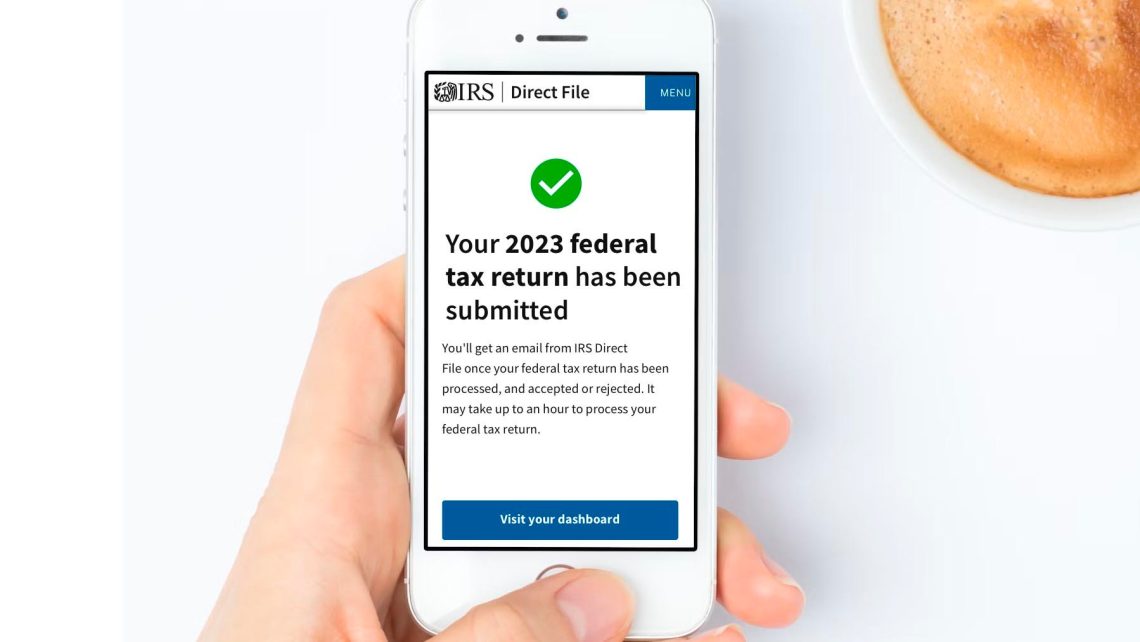

The news of the extension of the Free File program comes a month after the Federal Tax Agency reported that its Direct File pilot program served as a platform for filing taxes to more than 140,000 taxpayers who managed to do so successfully.

IRS Direct File saved taxpayers $5.6 million in tax preparation fees for federal returns that they would otherwise have had to pay to businesses or tax preparers.

By the end of the spring, the IRS is expected to define the future of Direct File and it will be known if it will be available for the next tax seasons as it did now with Free File.

For now, only those who live in two participating states are eligible to use the IRS Direct File program:

- Arizona

- California

- Colorado

- Connecticut

- Georgia

- Idaho

- Illinois

- Massachusetts

- New Jersey

- New York

- Oklahoma

- Texas.

In addition, a few eligibility requirements must be met. You can use the eligibility verification tool at https://directfile.irs.gov/ to see if he qualifies.