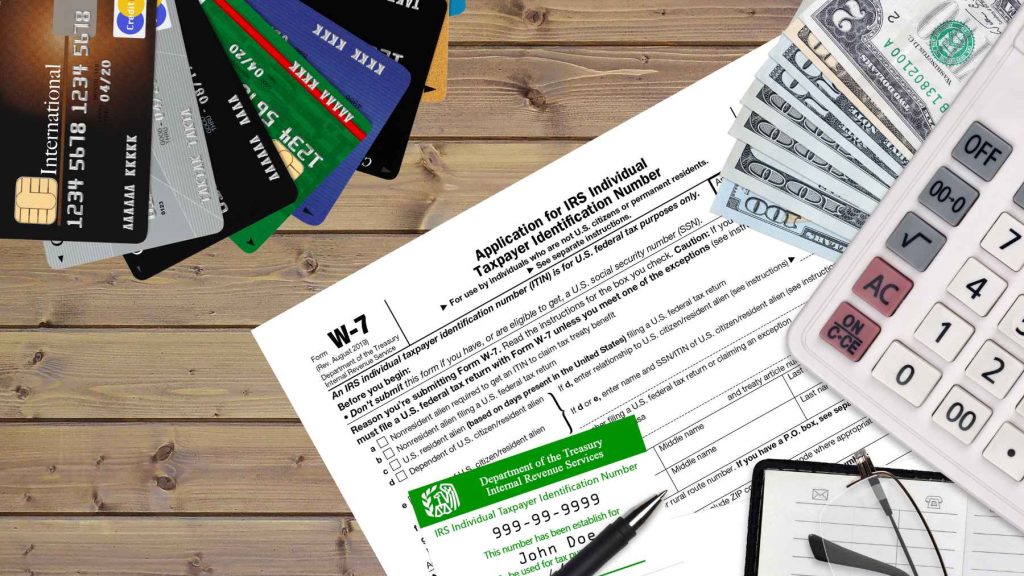

The Internal Revenue Service (IRS) is considering significant changes that could make the tax payment process easier for American taxpayers. Currently, paying taxes with credit or debit cards involves going through third-party processors, which can be expensive and time-consuming.

However, in recent days the IRS has proposed new regulations that could simplify and streamline this process, allowing the federal tax agency to directly accept these payments, eliminating the need for intermediaries and offering more options to taxpayers.

New IRS Regulations Could Simplify Credit, Debit Tax Payments

According to the regulations currently in effect, taxpayers must pay a processing fee to third parties for the use of credit or debit cards to pay their taxes, and that is an additional expense for them.

These fees may include a variable percentage of the amount paid by credit card and a fixed fee for the use of debit card. The IRS proposal seeks to modify these regulations, eliminating the previous prohibition that prevented the agency from paying these fees directly under certain conditions.

The Taxpayer First Act of 2019 (TFA) introduced significant changes to the tax code to allow the IRS to negotiate contracts involving the payment of fees for the use of credit or debit cards, as long as these fees are fully recovered from taxpayers.

Proposed IRS Changes for Credit, Debit Tax Payments: What to Expect

This adjustment aims to align the IRS with other entities that accept card payments, providing a guaranteed receipt of funds and reducing the costs associated with the processing of paper checks.

The proposed new regulations would allow the IRS to establish direct contracts with third parties to process tax payments by credit or debit cards, as long as these contracts offer a clear cost benefit to the government.

This could result in greater efficiency and convenience for taxpayers, who could make their tax card payments directly to the IRS, even by phone, without having to wait to be connected to external processors.

In addition, the proposed regulations would also establish mechanisms for taxpayers to pay processing fees directly at the time of card tax payment. This ensures transparency and clarity in the payment process, ensuring that any associated fees are adjusted fairly and efficiently.

Paying the IRS With a Credit Card? Be Really Careful!

Paying off your IRS debt with a credit card could lead to problems, if you don’t know how to do it right

Paying off IRS debt by credit card may seem like a convenient and quick solution for many taxpayers. However, this option also carries certain important disadvantages that it is essential to consider before making a decision.

One of the main aspects to keep in mind are the processing fees that are usually applied. When using a credit card to pay taxes, taxpayers often face fees that include a fixed amount plus a percentage of the amount paid. These fees can add up quickly, especially if it’s a significant tax debt.

In addition to fees, another factor to consider is the interest that accrues on the balance owed if it is not paid in full immediately. Credit card interest rates can be high, which could greatly increase the total cost of tax debt in the long run.

Another potential disadvantage is the impact on personal credit. Using a large part of the available credit limit can negatively affect the taxpayer’s credit score, which could make it difficult to obtain future loans or affect the available interest rates.

In addition to these points, it is important to consider the credit limits available on the card. Depending on the amount of taxes that must be paid, it may not be possible to cover the entire balance with the credit card, which would require looking for other forms of financing to cover the difference.

Finally, some credit card issuers may apply additional fees for special transactions such as tax payments, which should also be taken into account when evaluating this option.