The Social Security Administration (SSA) calendar for the month of April just completed, this week, all payments for retirement benefits and other programs such as SSDI (disabled workers) or Supplemental Security Income (SSI, for people with low income or disabilities that prevent them from working). That is why, now, millions of Americans are already looking for their next payment dates.

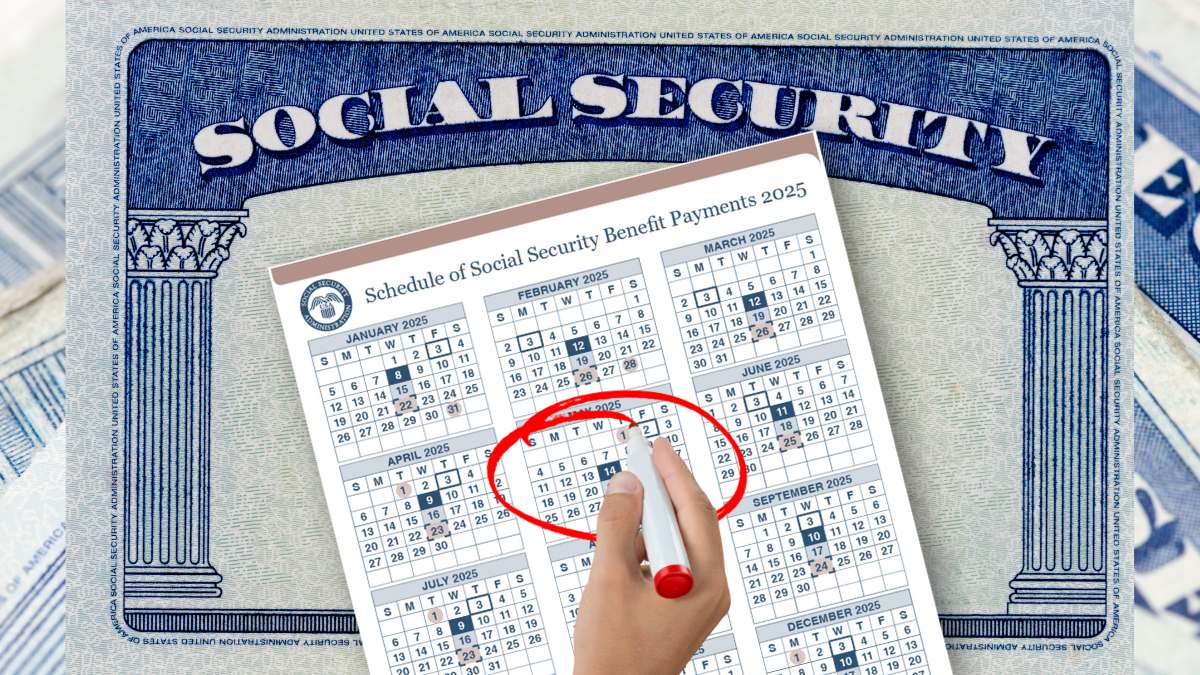

Social Security beneficiaries in the United States will receive their payments in May 2025 according to a schedule that considers dates of birth and adjustments for non-business days. Official calendars and historical patterns indicate four main dates: May 2, 14, 21 and 28. This scheme avoids weekends and holidays, such as Memorial Day (May 26), which does not affect scheduled deliveries.

Social Security’s scheduled dates for May 2025

The Social Security Administration (SSA) states that payments are rescheduled to the previous business day if the original date falls on a holiday or weekend. For May 2025, federal holidays and the corresponding Wednesday distribution were verified.

Specific dates by group of beneficiaries in the month of May:

- Payments on the 3rd of each month: Those who received benefits before May 1997 will collect on May 2 (Friday), since the 3rd is Saturday.

- Born from 1 to 10: Second Wednesday (May 14).

- Born from 11 to 20: Third Wednesday (May 21).

- Born from 21 to 31: Fourth Wednesday (May 28).

- None of these dates require additional adjustment, according to the 2025 work calendar.

As we have said, the month of May 2025 includes Memorial Day (May 26, Monday), this does not alter the planned dates. SSA also does not make payments on weekends, which only impacted the May 3 payment, moved to the 2nd. SSI (Supplemental Income) recipients will receive their allotment on May 1, a business day.

How much will a retiree receive in 2025?

The SSA establishes different maximums, depending on aspects such as the age at which each individual decides to start claiming their benefits. In the year 2025, the federal agency establishes these maximum amounts:

- At age 62: $2,831 per month

- At full retirement age (FRA): $4,018 per month

- At age 70: $5,108 per month

Additionally, the SSA explains that the full retirement age varies depending on the year of birth, which is crucial to understanding the context:

- For those born in 1958, FRA is 66 years and 8 months.

- For those born in 1959, FRA is 66 years and 10 months.

- For those born in 1960 or later, FRA is 67 years.

The maximum amounts require that the retiree have had high income, generally reaching the maximum taxable limit during their career. In 2025, the maximum amount the SSA requires to deliver the maximum is $176,100. They must have accumulated at least 40 work credits, which we will explain.

The credits are earned by working and paying Social Security taxes. In 2025, you earn 1 credit for every $1,810 of income, with a maximum of 4 credits per year. This is equivalent to approximately 10 years of work, assuming you earn at least $7,240 per year (4 x $1,810). To reach the maximum benefit (up to $5,108/month at age 70 in 2025), you must also have high earnings for 35 years of work, but 40 credits are the minimum eligibility requirement.