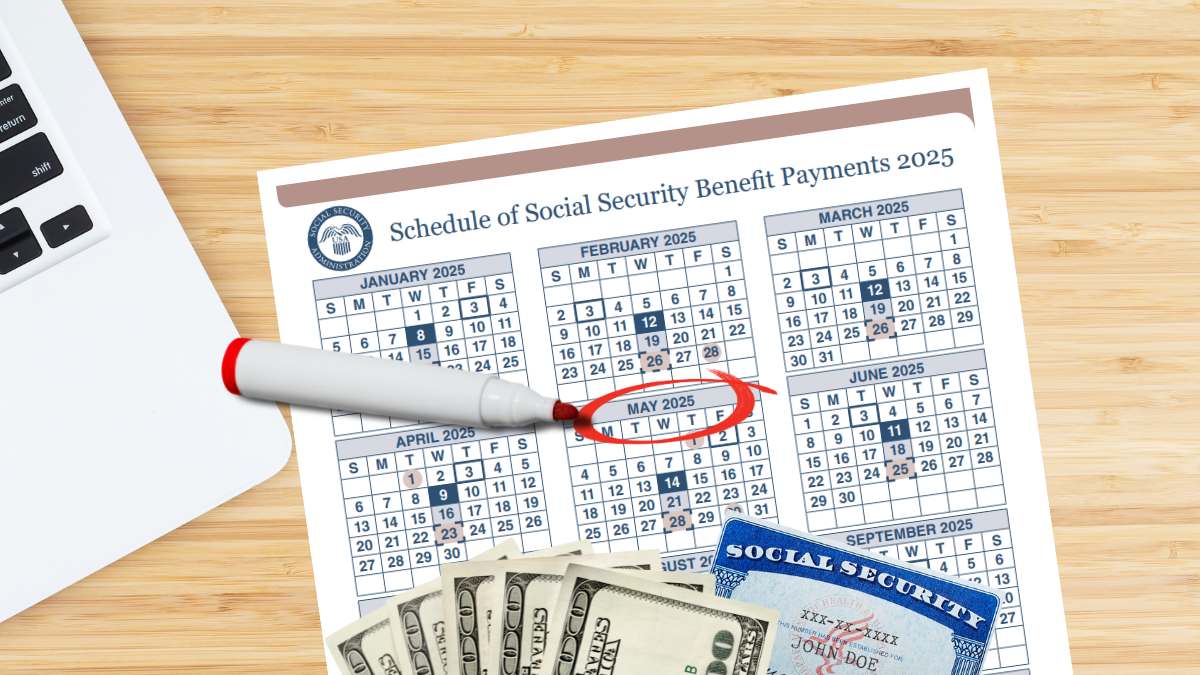

The Supplemental Security Income (SSI) scheduled its next disbursement for May 1, 2025, as confirmed by official sources. When the first day of the month falls on a weekend or federal holiday, payment is advanced to the last previous business day. For example, the June 2025 benefit, originally scheduled for Sunday, June 1, will be issued on Friday, May 30.

The SSI calendar states that payments are made on the first day of each month. However, if this date is not a business day, the deposit is made the previous business day. More than 99% of beneficiaries receive the money automatically in their bank accounts, while those who do not register financial data with the Social Security Administration (SSA) receive a physical check.

Next SSI payment could be up to $1,450

According to the Monthly Statistical Snapshot for February 2025 (published by the SSA), published in March of the same year, 7,414,000 people were receiving SSI in the United States. Of these, 4,888,000 were exclusive beneficiaries of the program, while 2,526,000 combined it with other Social Security payments. The figure includes older adults, people with disabilities and minors in critical medical condition.

The federal amounts for 2025 will reflect a 2.5% cost-of-living adjustment (COLA), applied since the last payment in December 2024. This will increase the monthly maximum values starting in January: $967 for single individuals, $1,450 for eligible couples, and $484 for “essential persons” residing with a primary beneficiary.

The “essential person” item is no longer available to request, but some beneficiaries still have it, because they obtained authorization to receive that amount when it was still activated.

Who can access SSI benefits?

To be considered “eligible” to receive the SSI payments, applicants must meet strict requirements. Among them, being at least 65 years old, being legally blind or having a documented disability that limits work activities for more than 12 months. Additionally, income and financial resources cannot exceed specific thresholds: $2,000 for individuals and $3,000 for couples, excluding a primary residence and a vehicle.

Interested parties must submit a formal request to the SSA, authorizing the verification of their financial and personal data. Immigration status is also key: only US citizens or legal residents in recognized categories can apply. After being approved, beneficiaries must report any changes in their income, residence, or family situation.

The program prioritizes those who live in all 50 states, Washington D.C. or the Northern Mariana Islands, and do not remain in government-funded institutions, such as hospitals or prisons. Failure to comply with these rules may result in temporary or permanent suspension of benefits.

This SSA initiative was also met by the 2.5% COLA increase approved by the agency for the entire year 2025. Since 1975, SSI has applied these increases annually, except in 2010, 2011, and 2016, when there were no increases due to minimal or negative inflation.